Salesforge has quickly become one of the top AI platforms for cold outreach.

It’s built to help teams automate prospecting, write personalized emails, and manage campaigns across email and LinkedIn with its AI SDR, Agent Frank.

But not every team needs the entire Forge setup.

Salesforge works best when paired with tools like Mailforge, Infraforge, and Warmforge for inbox creation, domain setup, and warm-up, which can make it more complex for small teams or agencies that just want to launch fast.

That’s why we evaluated the five best Salesforge alternatives to see which ones deliver the same outreach power with less setup complexity.

TL;DR – 5 Best Salesforge Alternatives

Stamina – All-in-one AI BDR platform that combines outreach, CRM, and deliverability tools in one place.

Smartlead – Scaling large cold email setups with unlimited mailboxes, warmups, and dedicated IPs.

Instantly – Affordable deliverability at scale with built-in warmup and lead database.

Lemlist – Multi-channel outreach across email, LinkedIn, and calls with creative personalization options.

ReachInbox – Budget-friendly AI-powered outreach tool with unlimited warmups and a unified inbox for replies.

Why Should You Look for Salesforge Alternatives?

Salesforge is one of the most capable AI-driven sales platforms, combining multi-channel outreach, deliverability tools, and Agent Frank for automation.

But when it comes to pure cold emailing and ease of setu, teams start exploring Salesforge alternatives for a few common issues:

Salesforge relies on Primebox™ for inbox management, but lacks a full CRM layer. Tools like Stamina and Smartlead include visual CRMs for managing deals and pipelines directly.

Salesforge starts at $48/month, but advanced automation (like API access or Agent Frank) can raise costs for smaller teams.

Platforms such as Instantly or ReachInbox offer simpler pricing for basic cold email operations.

Salesforge’s ecosystem depends on other Forge products (Mailforge for inboxes, Infraforge for setup, Warmforge for warm-up).

Some users prefer unified tools like Smartlead or Stamina, which handle everything under one dashboard.

With advanced deliverability controls and AI settings, onboarding can feel technical compared to plug-and-play options like Instantly or ReachInbox.

So, if you want a simpler, all-in-one system with less dependency and more flexibility, these alternatives can give you the same outreach power as Salesforge.

How We Evaluated the 5 Best Salesforge Alternatives

We evaluated how each Salesforge alternative performs in real cold email and sales outreach.

The goal was to find tools that are practical, deliver high inbox placement, and fit different budgets and team sizes.

Here’s what we looked at while evaluating them:

Deliverability performance was tested to see how often emails reached the primary inbox and how well warm-up networks worked.

Setup time was compared by checking how quickly each tool connects domains and starts sending campaigns.

AI features were reviewed to understand how each platform handles writing, personalization, and automation.

Reporting visibility was checked to see if users can track sender reputation, spam rate, and campaign-level stats easily.

Pricing transparency was reviewed to ensure the plans were clear, fair, and scalable for both individuals and agencies.

Ease of integration was considered to see how well each platform connects with CRMs, enrichment tools, or lead databases.

This helped us narrow down the Salesforge alternatives that aren’t just feature-rich but actually make cold emailing easier, faster, and more reliable.

1. Stamina - Best AI SDR Alternative to Salesforge

Stamina is an all-in-one AI sales platform that combines cold-email infrastructure, CRM, marketing automation, and an AI BDR named Zara who handles research, personalization, and outreach automatically.

It’s built for teams that want Salesforge-level automation without depending on external tools for infrastructure or warm-up.

Here are the key features of Stamina:

Zara AI BDR automates outbound prospecting and writing, researching leads, detecting buying signals like fundraisers or job posts, and creating personalized email sequences automatically.

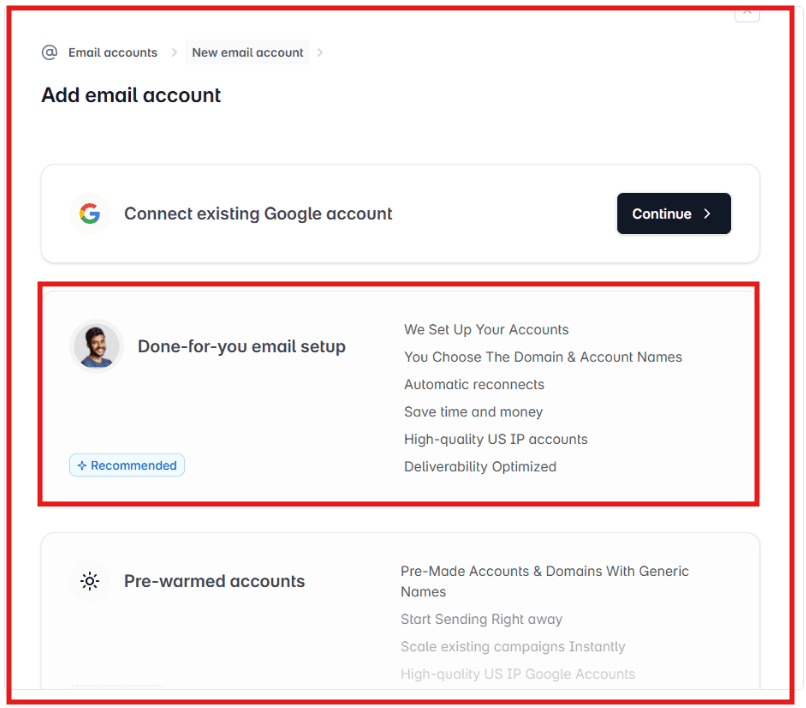

Done-for-you email setup with SPF, DKIM, and DMARC authentication helps teams start sending safely without manual DNS configuration or domain management.

AI warm-up system with 1M+ inboxes runs real email interactions to strengthen sender reputation and improve inbox placement rates.

Real-time deliverability dashboard tracks inbox placement and alerts you when sender reputation needs attention.

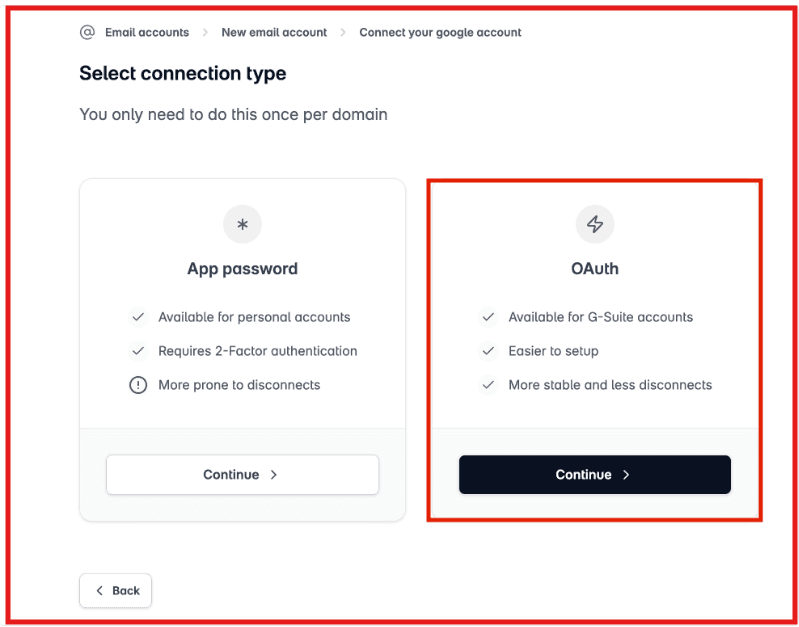

Google Workspace integration via OAuth allows a secure connection, warm-up automation, and deliverability monitoring directly inside your account.

Salesforge vs Stamina: Feature Comparison

Feature | Salesforge | Stamina |

AI SDR Agent | Agent Frank automates email + LinkedIn outreach | Zara AI BDR automates research + personalized email outreach |

Outreach Channels | Email + LinkedIn multi-channel | Email + SMS + Call (no LinkedIn) |

Infrastructure Setup | Uses Mailforge + Infraforge for domain and inbox creation | DFY domain provisioning + SPF/DKIM/DMARC auth included |

Warm-up System | Warmforge network with ESP matching | 1 M+ real inboxes auto warm-up pool |

Deliverability Control | Automated sender reputation + Primebox monitoring | Dynamic send limits + real-time placement tracking |

CRM & Data Layer | Primebox™ unified inbox (communication only) | Full CRM with custom objects + graph architecture |

White-Label Mode | Not available | Fully white-label SaaS for agencies |

API Access | Growth plan and above only | Included in Assisted / Enterprise tiers |

Starting Price | $48 / month (Pro plan) | $397 / month (Base plan) |

Pros of Stamina

Zara’s AI-led personalization saves hours by removing the need for manual research and message writing.

Stamina’s integrated CRM improves coordination, helping teams manage leads, calls, and campaigns in one view.

Real-time deliverability tracking prevents inbox issues, giving visibility into sender health before reputation is harmed.

White-label mode creates new revenue streams for agencies by offering a branded outbound platform.

Cons of Stamina

No native LinkedIn or social outreach, which limits multi-channel engagement compared to Salesforge.

Initial domain setup can take up to 72 hours, delaying first campaign launches slightly.

Stamina Pricing

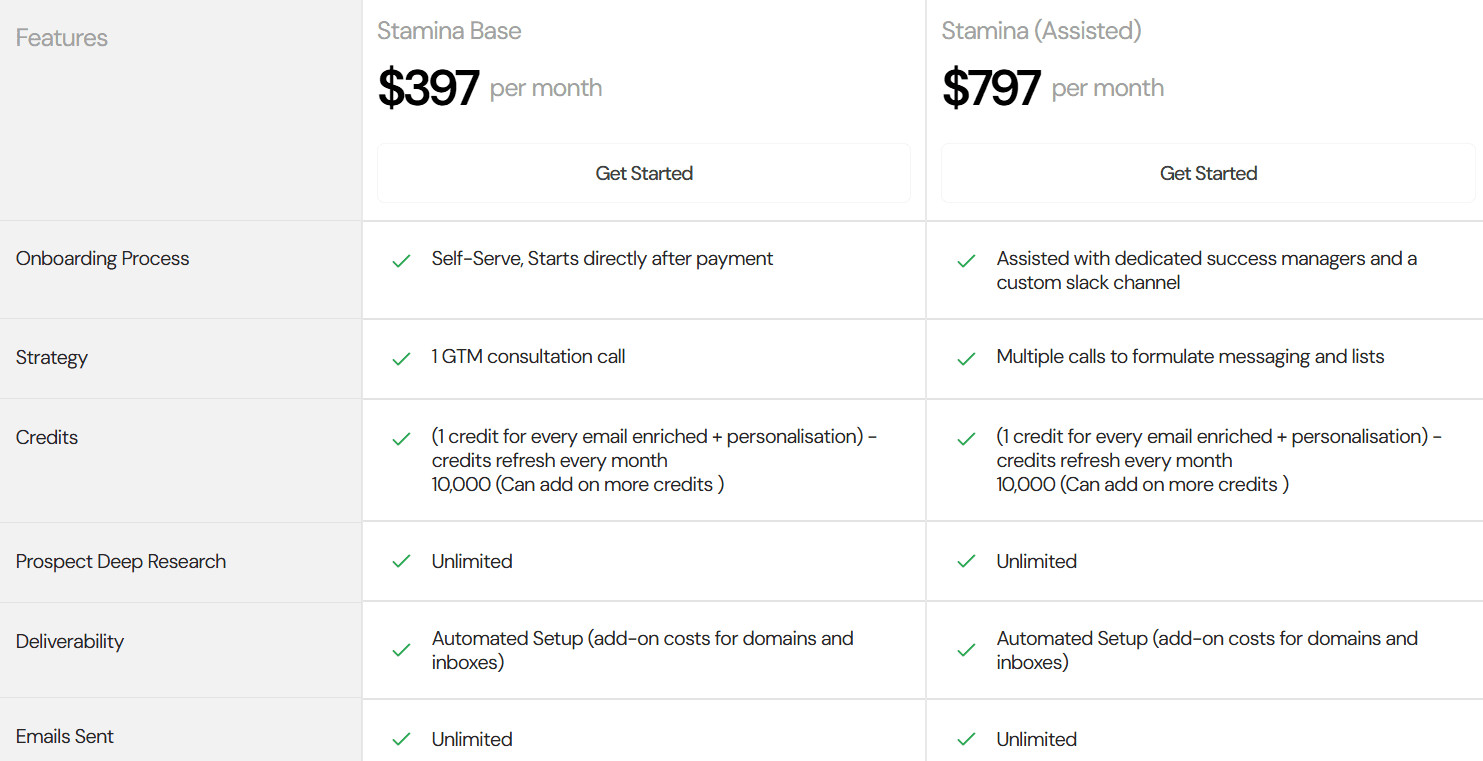

Base Plan – $397 / month, 1 GTM consultation, unlimited setup (add-on inboxes), chat support.

Assisted Plan – $797 / month, adds Slack channel, dedicated success manager, multiple strategy calls.

Enterprise / Whitelabel – Custom quote, multi-workspace support, API access, branding control.

2. Smartlead – Salesforge Alternative for Unlimited Cold Email Scale

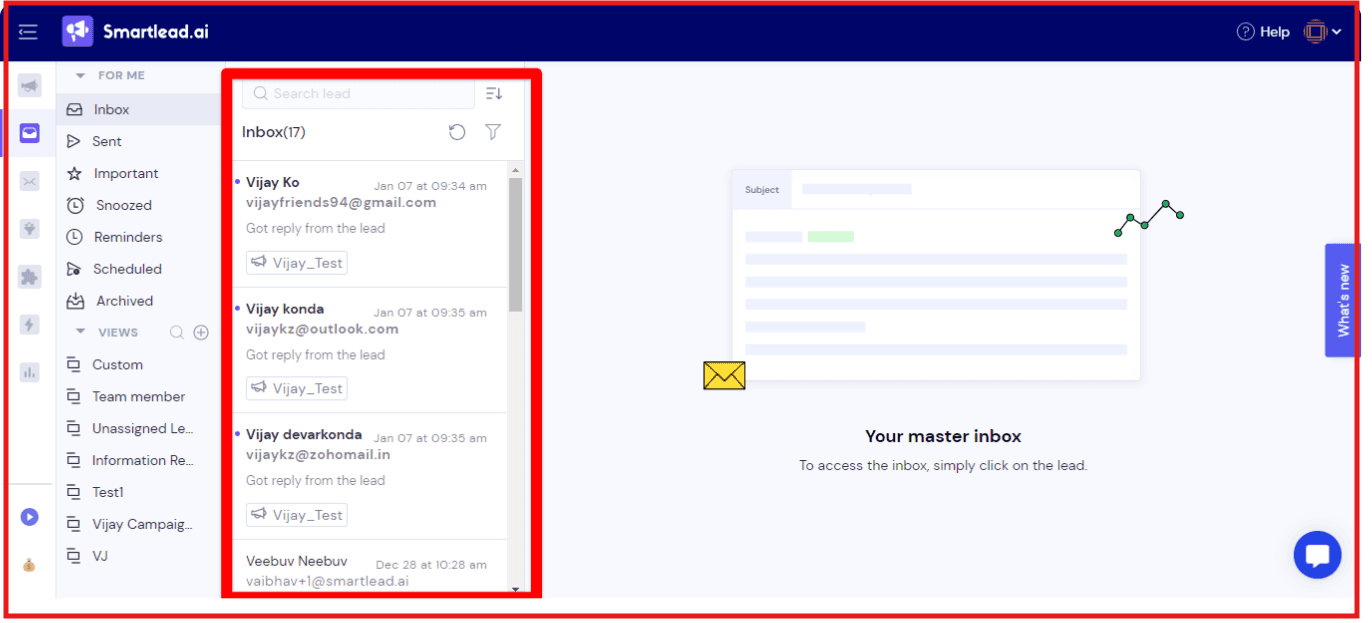

Smartlead is a cold email automation and deliverability platform that lets you scale outreach with unlimited mailboxes, unlimited warm-ups, and a unified master inbox.

Instead of connecting multiple Forge tools for infrastructure and warm-up, Smartlead brings everything under one roof, from mailbox setup to CRM to reputation monitoring.

Here are the key features of Smartlead:

You can use unlimited mailboxes with AI warm-ups, helping your team send from multiple domains safely while maintaining a strong sender reputation.

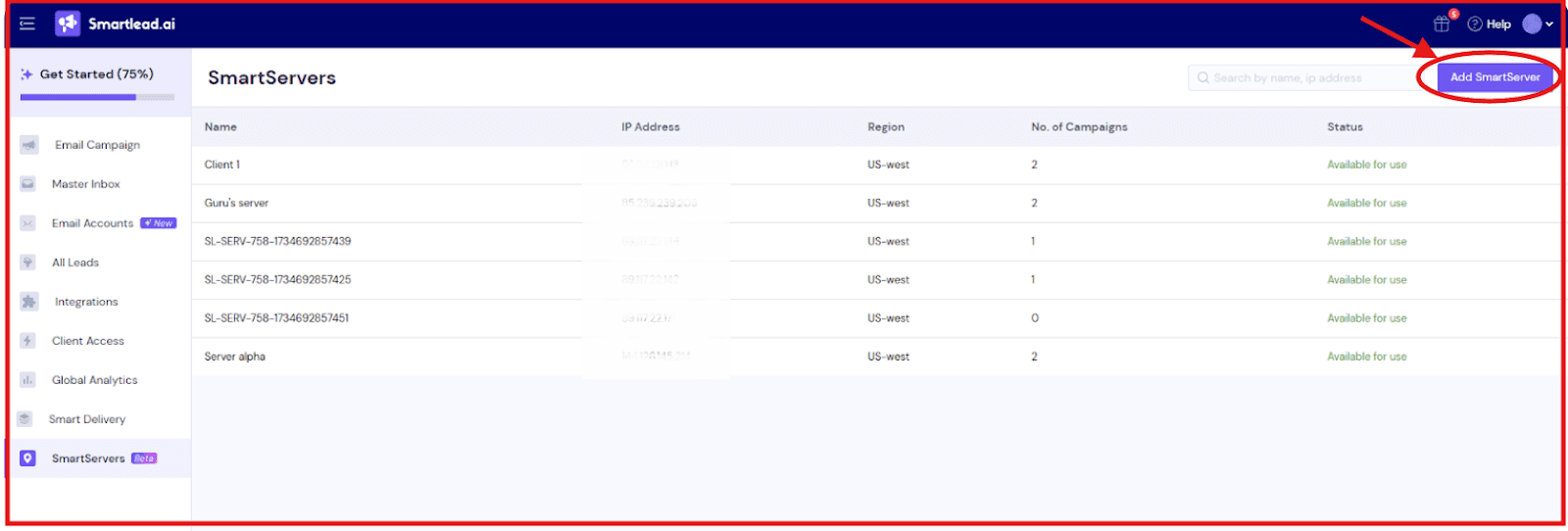

It gives you full control over infrastructure through SmartServers and SmartSenders, which handle IP rotation, blacklist alerts, and one-click setup for Gmail, Outlook, or SMTP mailboxes.

You can test inbox placement and spam risk in advance using SmartDelivery, which helps ensure your emails land in the primary inbox.

A Unified Master Inbox (Unibox) brings every reply and campaign into one view, so you can manage communication without switching accounts.

SmartAgents automate repetitive tasks like tagging, follow-ups, and categorizing leads right inside Slack.

Salesforge vs Smartlead: Feature Comparison

Feature | Salesforge | Smartlead |

AI SDR Agent | Agent Frank automates email + LinkedIn outreach | SmartAgents automate campaign setup, categorization, and follow-ups |

Outreach Channels | Email + LinkedIn multi-channel | Email-only with CRM and Slack integration (no LinkedIn) |

Infrastructure Setup | Uses Mailforge + Infraforge for inbox setup | Built-in SmartSenders & SmartServers for instant provisioning |

Warm-up System | Warmforge network with ESP matching | Unlimited AI warm-ups with natural conversations |

Deliverability Control | Primebox monitoring + Warmforge | SmartDelivery testing + bounce protection + AI warmup |

CRM & Data Layer | Primebox™ unified inbox (communication only) | Full Smart Funnel CRM with pipeline and Kanban view |

White-Label Mode | Not available | Available ($29/client) with custom domain and client dashboard |

API Access | Growth plan and above only | Full API + Webhooks in all paid plans |

Starting Price | $48 / month (Pro plan) | $39 / month (Basic plan) |

Pros of Smartlead

Unlimited mailboxes and warm-ups make it easy to scale without extra cost or separate warm-up tools.

SmartDelivery placement tests help fine-tune campaigns for consistent inbox placement.

Smart Funnel CRM eliminates the need for third-party CRMs, allowing you to manage deals directly inside Smartlead.

White-label access gives agencies the flexibility to offer Smartlead as their own branded platform.

Cons of Smartlead

No LinkedIn or SMS channels, making it less versatile for multi-channel outreach compared to Salesforge.

Initial setup for SmartServers can take time for first-time users to configure properly.

Advanced CRM and white-label features are available only in higher-tier plans.

Smartlead Pricing

Basic Plan – $39 / month: 2,000 active leads, 6,000 emails/month, unlimited warm-ups and mailboxes, centralized inbox, API access.

Pro Plan – $94 / month: 30,000 leads, 150,000 emails/month, AI copy guide, integrations, chat support, global block list, unlimited seats.

Custom Plan – $174 / month and above: Up to 12M leads, 60M emails/month, all premium features, and white-label access ($29/client).

7 Best Smartlead Alternatives & Competitors For Cold Emailing

3. Instantly – Best Salesforge Alternative for AI-Powered Cold Email Automation

Instantly is a cold-email and lead-generation platform that automates outreach, deliverability, and enrichment in one place.

It’s made for teams who want Salesforge-level sending speed and inbox placement, but prefer a simple email-only setup instead of full multichannel automation.

Here are the key features of Instantly:

Unibox centralizes all replies from connected inboxes into one dashboard, helping you manage conversations.

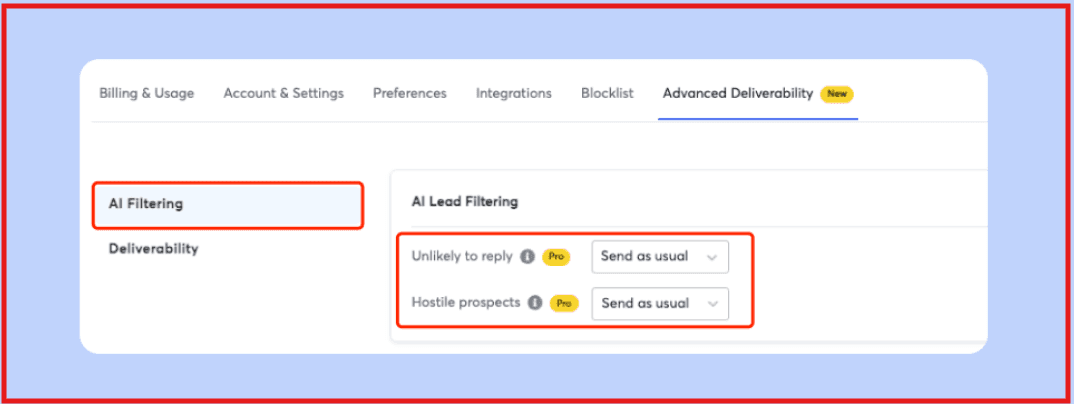

Advanced Deliverability Controls like AI lead filtering, text-only first email, ESP matching, and IP rotation keep campaigns compliant and consistent.

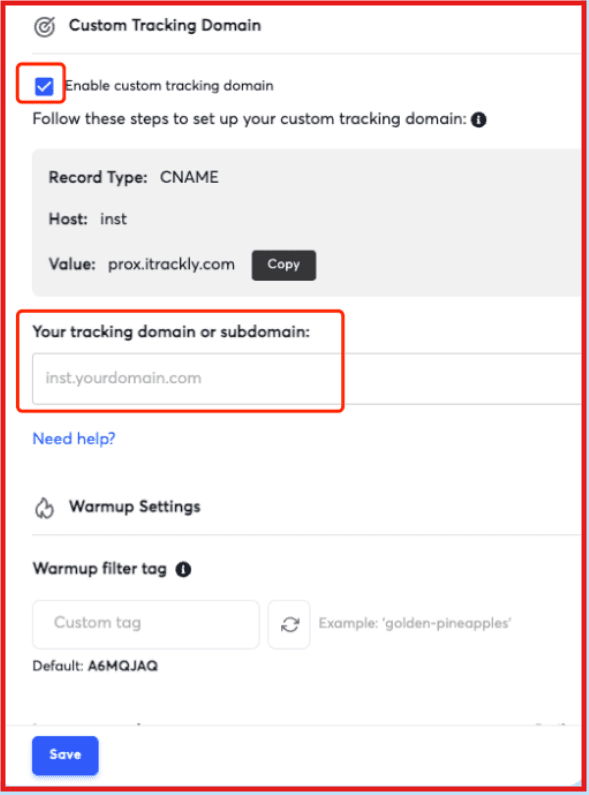

Custom Tracking Domain setup isolates your domain reputation from others, ensuring every user’s sending health stays independent.

Salesforge vs Instantly: Feature Comparison

Feature | Salesforge | Instantly |

AI SDR Agent | Agent Frank automates email + LinkedIn outreach | AI warm-up + AI lead filtering, no SDR agent |

Outreach Channels | Email + LinkedIn multi-channel | Email-only with deliverability automation |

Infrastructure Setup | Uses Mailforge + Infraforge for domain and inbox creation | OAuth + IMAP/SMTP setup for Google / Microsoft accounts |

Deliverability Control | Primebox + Warmforge monitoring | ESP matching, SISR rotation, AI filtering, text-only first emails |

CRM & Data Layer | Primebox™ unified inbox + contact management | Unibox + lead CRM + SuperSearch enrichment |

API Access | Growth plan and above only | Available in all paid plans |

Starting Price | $48 / month (Pro plan) | $9 / month (Nano plan) |

Pros of Instantly

SuperSearch gives verified B2B leads fast, with waterfall enrichment across multiple data providers.

Peer-to-peer warm-ups improve inbox placement by simulating real conversations.

Deliverability optimization (ESP matching, IP sharding, text-only first emails) helps maintain long-term sender health.

Built-in AI filtering prevents hostile or low-response leads from hurting reputation.

Cons of Instantly

Instantly lacks LinkedIn or phone outreach, so it can’t handle true multichannel campaigns like Salesforge.

CRM features are basic, better for tracking replies than managing full deal pipelines.

Custom tracking domain setup can take up to 72 hours to propagate for new users.

Instantly Pricing

Growth Plan – $47/month: 1,500–2,000 credits, access to 450M+ verified leads, AI enrichment tools, Web Research Agent, and CRM/export options.

Supersonic Plan – $97/month: 5,000–7,500 credits, includes all Growth features, higher enrichment volume, and advanced AI tools.

Hyper Plan – $197/month: 10K–200K credits, built for large teams managing bulk enrichment and high-volume outreach.

10 Instantly Alternatives That Deliver Better Cold Email Results

4. Lemlist – Best Multichannel Alternative to Salesforge

Lemlist is a sales engagement platform that helps you find leads, enrich contact info, and reach them through email, LinkedIn, WhatsApp, and calls.

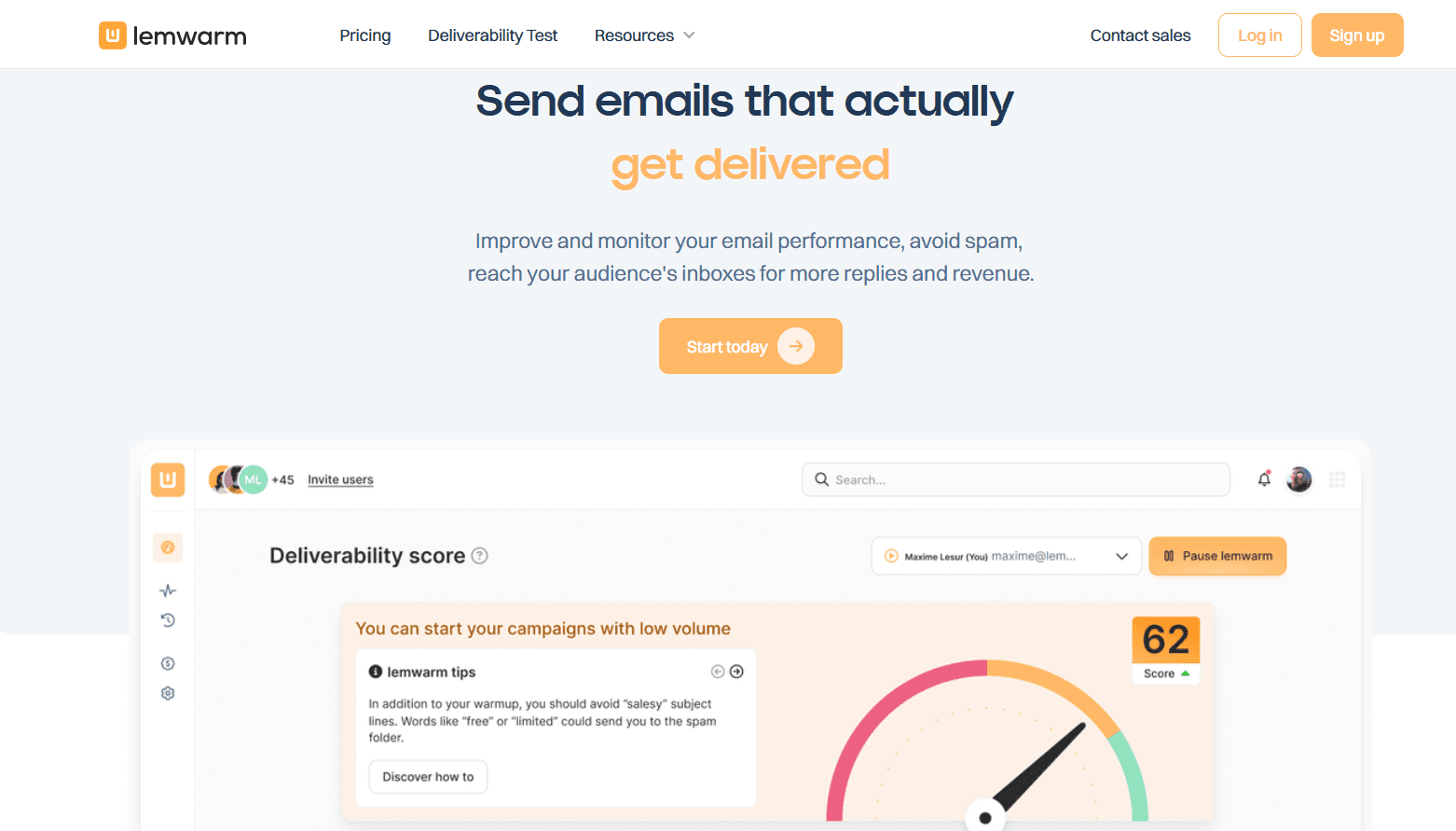

It’s designed for teams who want Salesforge-level personalization and automation, but with extended multichannel reach, including WhatsApp and calls, and built-in Lemwarm deliverability.

Here are the key features of Lemlist:

AI personalization engine adapts text, images, and landing pages dynamically for each prospect, making every message feel human-written.

Multichannel sequences automate outreach across email, LinkedIn, WhatsApp, and calls, helping you engage leads through their preferred channel.

Lemwarm deliverability booster warms up inboxes automatically and helps you stay out of spam with smart sending logic.

Unified multichannel inbox centralizes all replies and activities, giving your team one view of every conversation across channels.

Salesforge vs Lemlist: Feature Comparison

Feature | Salesforge | Lemlist |

AI SDR Agent | Agent Frank automates email + LinkedIn outreach | AI personalization across email, LinkedIn, WhatsApp, and calls |

Outreach Channels | Email + LinkedIn | Email + LinkedIn + WhatsApp + Calls |

Infrastructure Setup | Uses Mailforge + Infraforge for DNS and inbox creation | Native Gmail/Outlook setup with built-in warm-up |

Warm-up System | Warmforge network with ESP matching | Lemwarm deliverability booster included |

Deliverability Control | Primebox™ + Warmforge deliverability tracking | Inbox rotation, warm-up, DNS health checks |

White-Label Mode | Not available | Agency cockpit with roles and sub-workspaces |

API Access | Growth plan and above | Available in Enterprise plan |

Starting Price | $48/month (Pro plan) | $69/month (Email Pro plan) |

Pros of Lemlist

The platform automates outreach across multiple channels, saving hours of manual work.

Dynamic personalization helps create natural, non-AI-sounding outreach at scale.

The unified inbox simplifies communication management across email and LinkedIn.

Cons of Lemlist

Pricing scales per user, which can get expensive for large teams.

No phone outreach automation unless using paid add-ons like Aircall or Ringover.

DNS setup and warm-up period can delay campaign launch by a few days.

Lemlist Pricing

Email Pro – $69/user/month: Automated outreach, AI personalization, 600M+ lead database, email warm-up, and 3 sending inboxes per user.

Multichannel Expert – $99/user/month: Everything in Email Pro plus LinkedIn automation, WhatsApp add-on, calling features, and centralized inbox.

Enterprise – Custom Pricing: For large teams with dedicated support, API access, multi-seat control, and advanced security options.

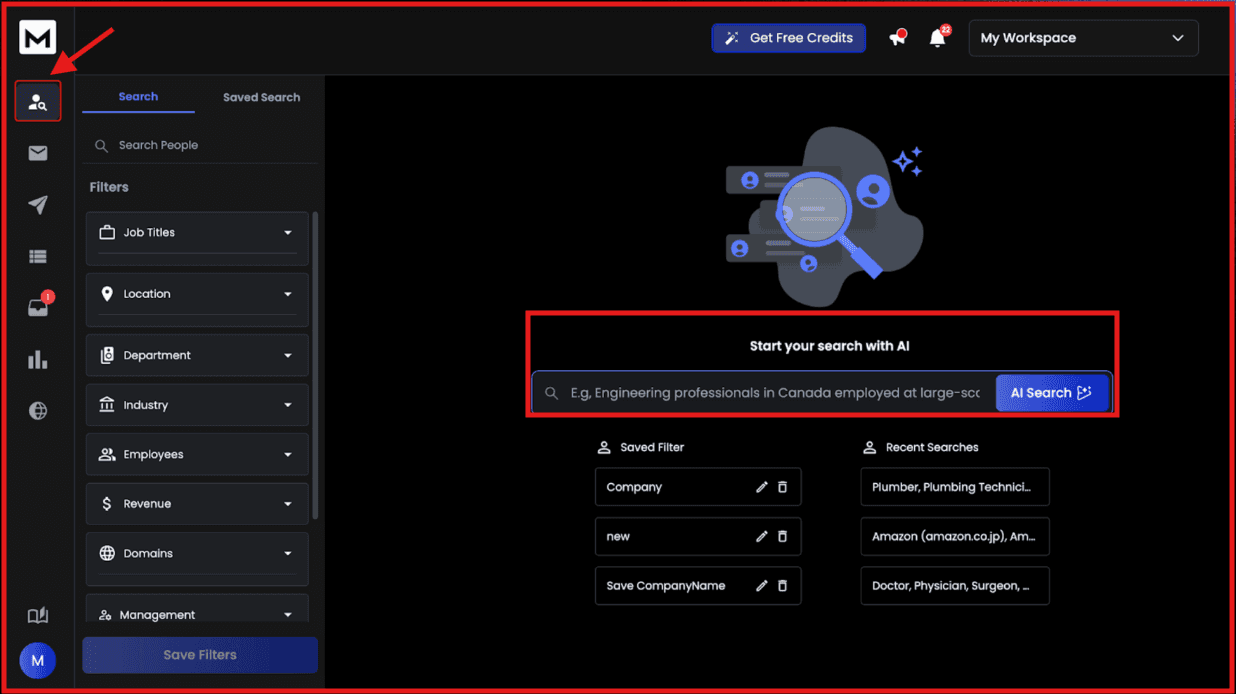

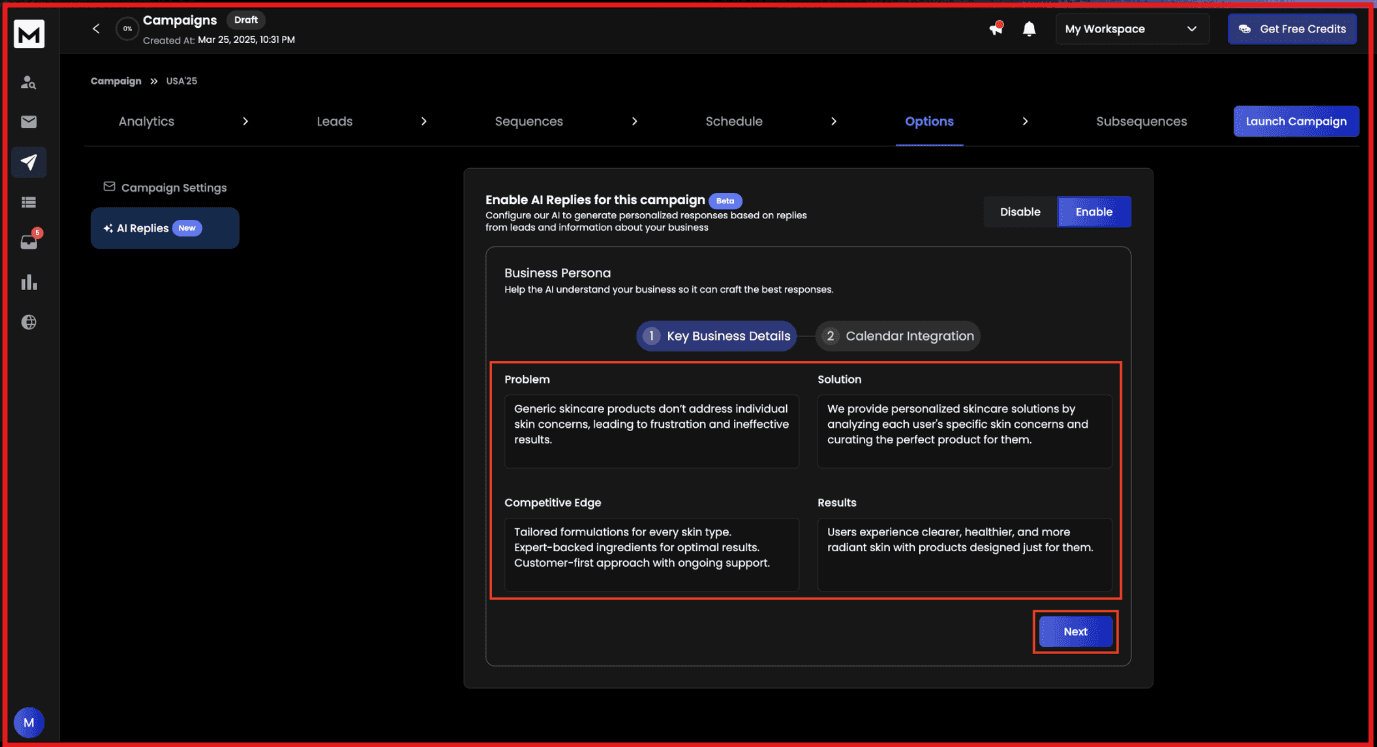

5. ReachInbox – Best All-in-One AI Cold Outreach Alternative to Salesforge

ReachInbox is an AI-powered cold email outreach platform that helps you find verified leads, warm up your inboxes, and send highly personalized emails that actually land in the inbox.

It offers built-in lead sourcing, unlimited AI warm-up, and done-for-you authenticated mailboxes without needing extra integrations like Leadsforge or Warmforge.

Here are the key features of ReachInbox:

AI Lead Finder helps you discover verified decision-makers from a 300M+ contact database, based on your ideal customer profile written in plain English.

AI Reply Agent generates personalized outreach sequences for each lead in seconds, analyzing tone, role, and company context automatically.

Spam Checker + Spintax automatically removes flagged keywords and creates hundreds of unique variations for each message.

API + Webhooks integrate your campaigns with CRMs or lead sources, automating enrichment and outreach workflows.

Salesforge vs ReachInbox: Feature Comparison

Feature | Salesforge | ReachInbox |

AI SDR Agent | Agent Frank for email + LinkedIn outreach | Magic AI Generator for personalized cold email sequences |

Outreach Channels | Email + LinkedIn | Email-only, but with smart follow-up automation |

Warm-Up System | Warmforge network with ESP matching | Unlimited AI Warm-Up included |

Deliverability Control | Primebox™ + Warmforge tracking | Real-time deliverability dashboard + spam checker |

Lead Database | Uses Leadsforge for verified data | Built-in 300M+ lead finder with AI prompts |

Infrastructure Setup | Uses Infraforge for domains & inboxes | Done-For-You inboxes ($4/mo) + instant DNS setup |

Unified Inbox | Primebox™ | Onebox with AI sentiment sorting |

API & Webhooks | Available on Growth plan and above | Built-in for Growth and higher tiers |

Starting Price | $48/month (Pro plan) | $0 Free plan, paid from $39/month (Starter plan) |

Pros of ReachInbox

The Onebox unified inbox automatically categorizes replies by sentiment, making it easier to manage responses across all campaigns.

Spam checker and spintax generator automatically optimize every message for deliverability, reducing bounce and spam rates.

Done-for-you mailboxes come pre-configured with SPF, DKIM, and DMARC, letting teams start sending safely within minutes.

Cons of ReachInbox

Multichannel outreach (LinkedIn, WhatsApp, calls) isn’t available, email only.

Email credits and AI credits have limits per plan, which reset monthly.

Requires manual setup if you import external mailboxes instead of buying pre-configured ones.

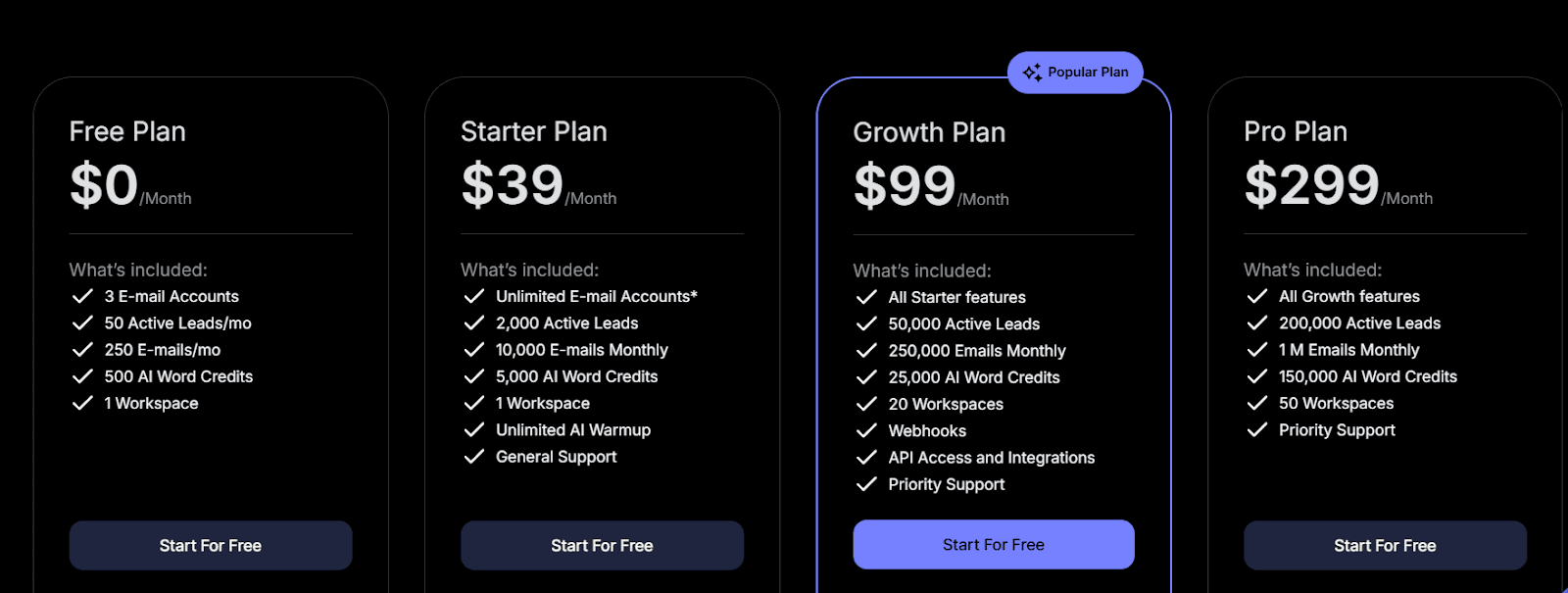

ReachInbox Pricing

Free – $0/month: 3 email accounts, 50 active leads, 250 emails, 500 AI word credits, 1 workspace.

Starter – $39/month: Unlimited accounts, 2,000 leads, 10,000 emails, 5,000 AI credits, unlimited warm-up, general support.

Growth – $99/month: 50,000 leads, 250,000 emails, 25,000 AI credits, 20 workspaces, API & webhooks, priority support.

Pro – $299/month: 200,000 leads, 1M emails, 150,000 AI credits, 50 workspaces, advanced analytics, priority support.

Enterprise – from $999/month: 500,000 leads, 1M+ emails, unlimited mailboxes, unlimited warm-up, white labeling, dedicated manager.

Which Salesforge Alternative Should You Choose?

Salesforge is a strong outreach tool, but depending on how you scale or automate your campaigns, another platform might fit better.

Here’s a quick overview to help you decide:

For full AI automation and CRM integration, Stamina gives you an AI SDR (Zara) that researches, writes, and sends personalized emails while managing your leads in one place.

For high-volume cold emailing, Smartlead offers unlimited mailboxes and warm-ups with full deliverability control.

For simple email-only campaigns, Instantly provides a smooth setup with AI warm-up and verified leads.

For multichannel outreach, Lemlist covers email, LinkedIn, WhatsApp, and calls in one sequence.

For teams on a budget, ReachInbox combines AI writing, warm-up, and inbox management affordably.

But if your main goal is scaling outreach with AI-led automation, CRM visibility, and consistent deliverability, go with Stamina.

Start with Stamina and run your entire outbound workflow, from research to follow-ups, using one smart AI SDR.

Frequently Asked Questions

1. What is Salesforge used for?

Salesforge is an AI-powered multichannel sales platform that helps automate cold outreach through email and LinkedIn.

It includes Agent Frank (AI SDR) for personalization, Primebox™ for unified inbox management, and connects with Mailforge, Warmforge, and Infraforge for inbox setup, deliverability, and DNS automation.

2. Which Salesforge alternative is best for cold email only?

If your focus is only cold emailing, Instantly and ReachInbox are better fits.

Both include AI warm-up, inbox rotation, spam checker, and deliverability control in one platform — without needing extra integrations.

4. Which Salesforge alternative includes a full CRM?

Smartlead and Stamina both include built-in CRMs.

Smartlead offers a Smart Funnel CRM for visual pipeline tracking, while Stamina provides a graph-based CRM with call, email, and lead management in one dashboard.